Home Loan Variable: 5.94% (5.95%*) • Home Loan Fixed: 5.79% (6.39%*) • Fixed: 5.79% (6.39%*) • Variable: 5.94% (5.95%*) • Investment IO: 6.14% (6.58%*) • Investment PI: 5.99% (6.61%*)

DO I QUALIFY FOR A FEDERAL GOVERNMENT GRANT?

The First Home Loan Deposit Scheme, which started on 1 January 2020, will be targeted towards first home buyers earning up to $125,000 annually or $200,000 for couples. The value of homes that can be purchased under the Scheme will be determined on a regional basis, reflecting the different property markets across Australia.

The First Home Loan Deposit Scheme will mean first home buyers won’t need to save for a full 20 per cent deposit, so Australians can get a loan and into the market faster. The Scheme will also help first home buyers save around $10,000 by not having to pay Lenders Mortgage Insurance.

For a property to be eligible it must be a ‘residential property’ – this term has a particular meaning under this Scheme. Eligible residential properties include:

- an existing house, townhouse or apartment

- a house and land package

- land and a separate contract to build a home

- an off-the-plan apartment or townhouse

Specific dates and requirements apply for the different property types, and different timeframes can apply to your Scheme place, depending on the type of home you buy. One of our brokers will make this information available to you.

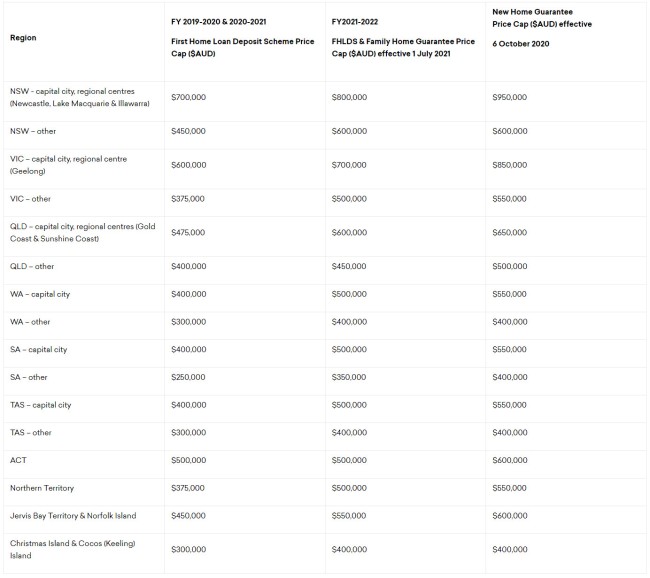

Property price caps vary according to which financial year is applicable to your scheme place, and where your property is located (in a capital city, large regional centre or regional area). The table shown below provides a basic understanding of the caps, but one of our brokers should be consulted for a more accurate understanding.

To be eligible for this Scheme, the contract of sale and (if applicable) eligible building contract may have particular dates when they can be signed by you. There are no exceptions from these required dates.

How Much Do I Need to Save?

You need to have between 5% and 20% of the value of an eligible property saved as a deposit. While the minimum deposit required by this Scheme is 5%, Participating Lenders may require a higher percentage deposit based on your financial circumstances. Speak with your lender to find out whether the deposit you have is made up of genuine savings for the purposes of their lending criteria and this Scheme.

Participating Lenders

Participating lenders are as follows (this list may change). We’ll have more relevant and up-to-date information for you when we have a discussion.

Scheme Qualification

The basic qualification requirements apply to scheme participants:

- applying as an individual or couple (married / de facto)

- being Australian citizen(s) at the time you enter the loan

- being at least 18 years of age

- earning up to $125,000 for individuals or $200,000 for couples

- you must intend to be owner-occupiers of the purchased property

- you must be first home buyers who have not previously owned, or had an interest in, a property in Australia

More Information

More information is available on the Government’s First Home website . Download a fact sheet from the NHFIC website here .

Contact us for the current state of available subsidies and grants.

RELATED FAQS:

A Risk Fee is a once-off charge payable by you when the amount of money you borrow for the purchase of a home or asset if higher than that lender’s acceptable LVR. For a home loan, this is usually 80% of the value of the home (80% LVR) …

Most lenders have moved away from the no-deposit home loan, although there are a few products available with very strict criteria. Excluding the no-deposit opportunities made available to the medial industry and other …

When you apply for a home loan, a lender will take a large number of factors into consideration when deciding whether or not to approve your application. The Serviceability assessment determines if you can comfortably “service” the loan repayments after considering all of your …

SHARE THIS FAQ

❯ Home Loans ❯ Car & Equipment Finance ❯ Mortgage Calculators ❯ FAQ ❯ Resources ❯ Education ❯ Insurance ❯ Real Estate ❯ Business ❯ Review Bank Products ❯ Search BSB Numbers ❯ Social Media Archive ❯ Video Archive ❯ Downloads ❯ About Us ❯ Finance Team

The comparison rate is calculated on a secured loan of $150,000 with a term of 25 years with monthly principal and interest payments. WARNING: This comparison rate is true only for examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate. Important Information: Applications are subject to credit approval. Full terms and conditions will be included in our loan offer. Fees and charges are payable. Interest rates are subject to change. Offer does not apply to internal refinances and is not transferable between loans. As this advice has been prepared without considering your objectives, financial situation or needs, you should consider its appropriateness to your circumstances before acting on the advice.

© LOAN SAFARI ABN 94 143 496 100 ACL 384704 | PRIVACY • TERMS • DISCLAIMER