Home Loan Variable: 5.94% (5.95%*) • Home Loan Fixed: 5.79% (6.39%*) • Fixed: 5.79% (6.39%*) • Variable: 5.94% (5.95%*) • Investment IO: 6.14% (6.58%*) • Investment PI: 5.99% (6.61%*)

WHAT IS THE LVR, LOAN TO VALUE RATIO?

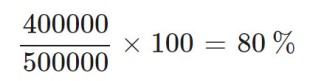

The Loan to Value Ratio (LVR) is the amount you’re borrowing represented as a percentage of the property’s value. The loan amount is divided by the purchase price of the valuation amount, then multiplied by 100 to make a percentage. For example, if you’re purchasing a home worth $500,000 and you wish to borrow $400,000 (so, you have a $100,000 deposit), the LVR is 80%.

The higher your deposit the lower your LVR. A Refinancing LVR is calculated in the same way.

Calculate Your LVR

This simple tool will simply return an LVR based on your borrowing requirement.

As introduced below, the LVR is often used to determine if Lender’s Mortgage Insurance (LMI) is required.

What is the Significance of the LVR?

Lenders set their own limits on how high the LVR can go for any specific product (our bank product pages are a good reference as most LVR requirements are published with the product data). In most very general cases you’ll require a 20% deposit to qualify for most home loans, although First Home Buyer Grants, both at the state and federal level, tends to mitigate this requirement.

LMI (or Lender’s Mortgage Insurance), or having a guarantor, are other means upon which to navigate the LMI requirement imposed upon us by way of the LVR.

Bottom line: the lower the LVR, the lower the risk is to the bank, hence you’re likely to get better rates with a low LVR home loans.

An LVR Doesn’t Qualify You For a Loan

An LVR that meets the bank criteria obviously isn’t the only factor that impacts upon your ability to qualify for a loan. You are still required to demonstrate your ability to service the loan to the bank’s satisfaction.

What is a Good LVR?

Most lenders consider home loans for 80% LVR and above to be a risk. A loan to value ratio under 80% is always a better borrowing option since you won’t necessarily incur Lenders Mortgage Insurance (LMI). LMI is insurance paid by you on behalf of the lender (it protects the lender, not you), and the specifics of LMI is introduced here.

LVR Requirements May Vary Based on Location or Postcode

in some cases an 80% LVR won’t meet the criteria set by certain banks if you’re buying in certain ‘higher risk’ postcodes (usually areas with an unpredictable property value). More common in rural or regional areas it isn’t uncommon to apply in city postcodes.

What is the Maximum LVR For Residential Borrowing?

Most banks will only lend up to 95% of the property’s value (this value is determined by an independent valuation and has little to do with what you actually pay for it). Again, conditions will normally apply for all lending over 80%, although stronger borrowers – particularly those that fit a ‘professional’ criteria – are normally considered low risk.

Do Lenders Always Value a Property?

No. Some banks do not require a valuation for a property that is being purchased if it meets particular criteria. Some banks will use a desktop valuation tool (AVM or computer-generated) or restricted assessment (drive-by valuation), instead of a more expensive and time-consuming full valuation, which requires a physical inspection of the property. The type of inspection is normally predicated on the LVR and perceived risk to the bank.

Will My Property Require a Valuation?

Banks will not necessarily value your property, and will normally adopt the price on the Contract of Sale to calculate your LVR, if you meet the below criteria:

- Your loan is at or below 80% LVR.

- You’re purchasing the property.

- Your loan is under $800,000.

- You have provided full evidence of your income.

- Your property is in a capital city or major regional centre.

- The purchase is through a licensed real estate agent.

- The property is not a new dwelling (off the plan or new building).

- You are not related to the vendor.

Valuation policy varies from bank to bank.

Related Articles in our Blog

You may find useful information and articles in our blog. Feel free to call anytime on 0422438634 for any reason.

RELATED FAQS:

A Risk Fee is a once-off charge payable by you when the amount of money you borrow for the purchase of a home or asset if higher than that lender’s acceptable LVR. For a home loan, this is usually 80% of the value of the home (80% LVR) …

Most lenders have moved away from the no-deposit home loan, although there are a few products available with very strict criteria. Excluding the no-deposit opportunities made available to the medial industry and other …

When you apply for a home loan, a lender will take a large number of factors into consideration when deciding whether or not to approve your application. The Serviceability assessment determines if you can comfortably “service” the loan repayments after considering all of your …

SHARE THIS FAQ

❯ Home Loans ❯ Car & Equipment Finance ❯ Mortgage Calculators ❯ FAQ ❯ Resources ❯ Education ❯ Insurance ❯ Real Estate ❯ Business ❯ Review Bank Products ❯ Search BSB Numbers ❯ Social Media Archive ❯ Video Archive ❯ Downloads ❯ About Us ❯ Finance Team

The comparison rate is calculated on a secured loan of $150,000 with a term of 25 years with monthly principal and interest payments. WARNING: This comparison rate is true only for examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate. Important Information: Applications are subject to credit approval. Full terms and conditions will be included in our loan offer. Fees and charges are payable. Interest rates are subject to change. Offer does not apply to internal refinances and is not transferable between loans. As this advice has been prepared without considering your objectives, financial situation or needs, you should consider its appropriateness to your circumstances before acting on the advice.

© LOAN SAFARI ABN 94 143 496 100 ACL 384704 | PRIVACY • TERMS • DISCLAIMER